so 12 million of us better leave right now ......

and go where? the Greens reckon the world is going to melt.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

so 12 million of us better leave right now ......

Something shifty about a number like that,10 million in each state would be more like it,and it's something that no one will be able to stop..willair..I read research few years ago showing Australian can sustainably support 10 million people only

But in the current political climate, with Republicans poised to make strong gains in the midterm elections while preaching fiscal austerity, the prospect of more federal stimulus spending seems remote, and it is unclear if monetary policy alone will be enough to restore healthy growth.

Partly as a result, some economists now predict that it could take years or even a decade for the American economy to regain the levels of employment and vigor achieved before the 2008 crisis. The growing political pressure for cuts in federal spending — along with plunging consumer confidence and companies that seem more intent on cutting costs and hoarding cash than investing in new growth — have led economists to talk of the United States’ entering a grim new era of austerity.

and go where? the Greens reckon the world is going to melt.

It's pretty much proven that most of his predictions have been wrong.

Sure the age groups will have an influence on economies, but he's curve fitting.

It's pretty much proven that most of his predictions have been wrong.

Sure the age groups will have an influence on economies, but he's curve fitting.

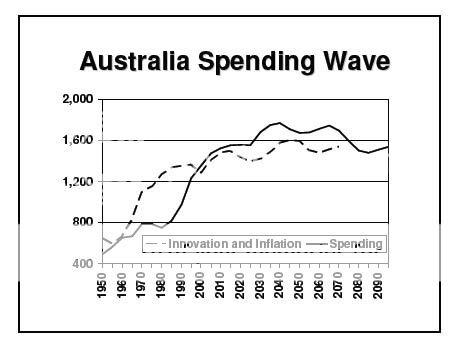

I dont believe that either, younger GenY & GenZ spend, and have spent on them, more imo.people who are aged between 40 and 50, they are far and away the largest spending age-group

Originally Posted by .toe

people who are aged between 40 and 50, they are far and away the largest spending age-group

I dont believe that either, younger GenY & GenZ spend, and have spent on them, more imo.

But who am I to contradict someone who writes book and does highly paid seminars on and correcting his own wrong forecasts.

You aren't just contradicting an individual author, you are contradicting virtually everything I've ever read about the boomer generation.

You aren't just contradicting an individual author, you are contradicting virtually everything I've ever read about the boomer generation.

Talking about Harry, he has just run a webinar and has now made it available for a limited time (till tomorrow).

So here is the link

http://r20.rs6.net/tn.jsp?llr=e4bbv...OK-ufc4BLkKPmFyQ9ra0Gio0hYXwb46vmxwjS44C0Uac=

obviously there is a sales advert at the end but none the less interesting to listen to.

I was trying to find some freeby software which would allow me to record sound and vision but have been unsuccessful - any hints greatly appreciated.

Cheers

Still cant figure out where the BB money went though....