And if that one deal doesn't pan out, what else has Darwin got?

Crocs and cyclones and backpackers!

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

And if that one deal doesn't pan out, what else has Darwin got?

Especially so, when RE is a long term investment and very forgiving even if you get it a bit wrong.

I would suggest that it is not "due to property" but rather due to mismanagement, poor selection, over-leveraging, developing, over paying, overcapitalising, and failure to engage in risk mitigation etc.Um, property can be exceedingly unforgiving if you get it wrong, I should know, I've personally seen quite a few "riches to rags" scenarios due to property.

This type of scenario would not be the typical play engaged in by the vast majority of owner occupiers or investors.It is not a liquid market, and there tends to be no 'out', due to the fact that by the time you have lined your ducks up, the market has moved once again.

I can't see why, if you went into it with a long term view, that you'd want to be engaging in a sale, let alone this kind of activity'Chasing the market down', tends to be the usual play.

Most people who buy RE do not watch it rise and fall in value on a month to month or quarter to quarter basis.The problem is that this is not a scenario known to many Australians, who quite understandably tend to view property from the rather narrow perspective of the protected Australian experience of the last several decades.

On this point we can agree.Learning from other peoples mistakes is also advised.

70% of RE is owner occupied, largely by people who don't care what its current value is amd who use P&I loans and therefore have some equity by paying down P even if their has been little CG since purchase. 30% is investor owned and some of that without a mortgage. "Rushing to the exits" is perhaps a term more akin to a falling share market. If (or when) the economy takes a hit, very often investors retreat to gold and to their other favourite, bricks and mortar (as it is less volatile).Lets just hope there isn't some rush to the exits, whilst being aware of the "uniqueness" of the Australian market.

I would suggest that it is not "due to property" but rather due to mismanagement, poor selection, over-leveraging, developing, over paying, overcapitalising, and failure to engage in risk mitigation etc.

This type of scenario would not be the typical play engaged in by the vast majority of owner occupiers or investors.

I can't see why, if you went into it with a long term view, that you'd want to be engaging in a sale, let alone this kind of activity

Most people who buy RE do not watch it rise and fall in value on a month to month or quarter to quarter basis.

On this point we can agree.

70% of RE is owner occupied, largely by people who don't care what its current value is amd who use P&I loans and therefore have some equity by paying down P even if their has been little CG since purchase. 30% is investor owned and some of that without a mortgage. "Rushing to the exits" is perhaps a term more akin to a falling share market. If (or when) the economy takes a hit, very often investors retreat to gold and to their other favourite, bricks and mortar (as it is less volatile).

Propertunity, you are starting to remind me of Chemical Ali in Baghdad. Denial and pushing the property spruiker line that all it good with the property market while the markets beings to fall around you.

But it's different here. Australia has a property supply and demand issue. Mind you, this argument was also used in every country where property eventually fell.

I'm loving watching the news. Oil up (will lead to inflation, and slowing economies, and higher interest rates), taxes up (new Carbon Tax next year) will put further screws on working families disposable income (dumb Labor voters deserve it), Europe with more debt issues (Portugal) now at 8.5% for 10yr bond. Bail out coming shortly this month Portugal 10 yr bond

Bad news is good news for the patient investor. All falling into place nicely. The property downward trend is gaining pace, which will burn the overleveraged, and provide very nice buying opportunities in 2013.

Darwin has a very large military garrison, which strengthens the local economyAnd if that one deal doesn't pan out, what else has Darwin got?

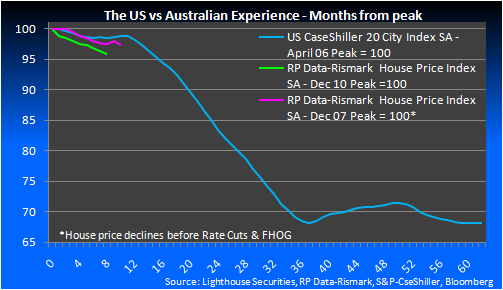

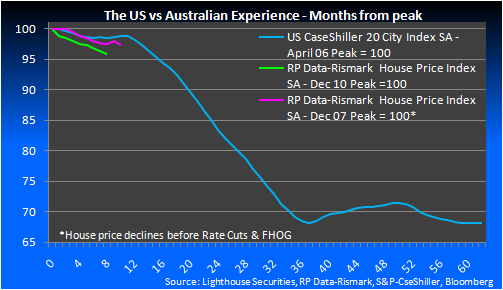

It seems that the fall in the appetite for, and price of, credit has been responsible for the slow melt in prices to date. Should prices fail to recover, it is likely that the selling pressure will intensify as investors can no longer justify holding on to properties that are falling in value and, with an unequivocal connection between falling house prices ad rising unemployment, we are unlikely to have seen any forced selling yet either:

Prices still falling.

Bucking the national trend, home values in Australia’s biggest city, Sydney, rose.......

EXCEPT for Sydney.

I guess it softens the blow of the .7% fall over the quarter

After costs?A 0.7% blow is about as painful as being hammered over the head with a marshmallow.

Sydney prices are up (very slightly) year-on-year, year-to-date, and also in the past month.

The RP Data-Rismark Home Value Index is not simply a median price:i think medians are shocking use for statistics.

all that says to me is that the activity in the selling sector has been mostly at values under median - which is no surprise.

Latest RPData index is out... http://www.rpdata.com/images/stories/content/pressreleases/rpdatarismarkhomevalueindexsep30.pdf

Prices still falling.

More at: http://www.macrobusiness.com.au/2011/09/the-not-so-slow-melt-of-housing

Data Sword, I’m not saying I disagree with your general assertion but based on that chart alone I’m afraid I’d have to bet against you. I think it fails to account for every occasion where property dropped 3-4%, & essentially that’s all it says, that property has dropped 3-4%.

I you want to win me on this chart over you’ll have to show me the evidence that Australia’s fundamental situation now is similar to the U.S. in 2007. Since our market had the chance to crash then and it didn’t I suggest that’ll be difficult.

Which is not to say I don’t see risk in our market, I just don’t see a correlation between the lines on your chart, sorry.