If you're talking about Australian Property Forum, that's not my site. I'm just a member there. It's run by a guy called Alex Barton. You post there as well, as 'tech_support' don't you?He's too busy running his own site and forum designed to hype the property market, a single thread is not thinking big enough...

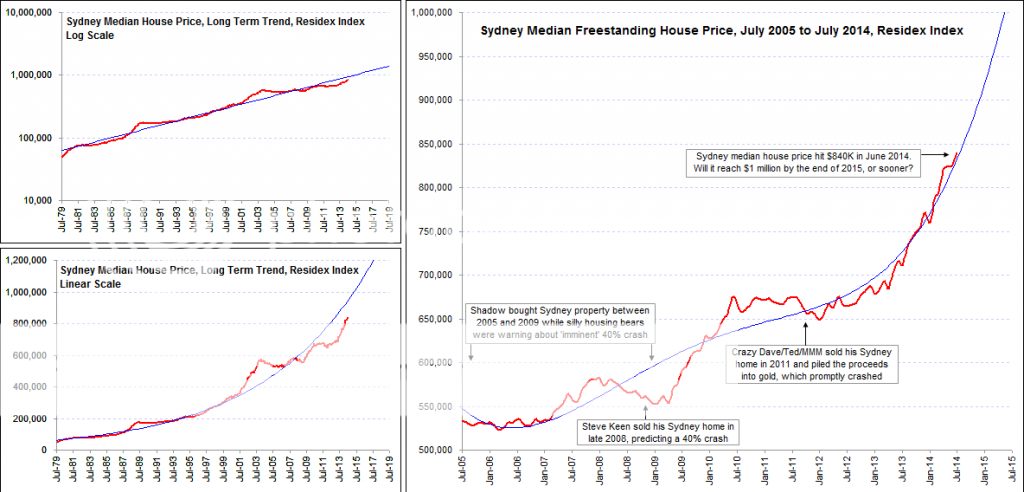

I just noticed this thread today, as I rarely look outside the Property Market Economics subforum of Somersoft. I posted a poll on that subforum a few days ago asking whether the Sydney median house price will hit $1 million next year.

My opinion is that it will certainly approach very close to $1 million by the end of 2015.

Here's the poll/thread... Poll: Will the Sydney median house price reach $1 million by the end of 2015?