Hi Guys,

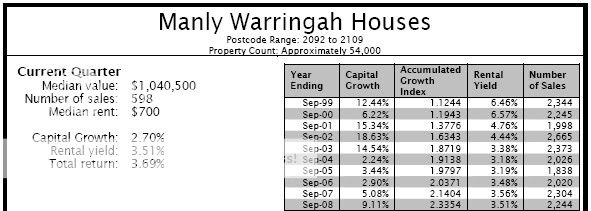

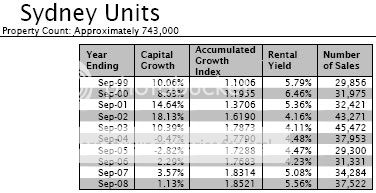

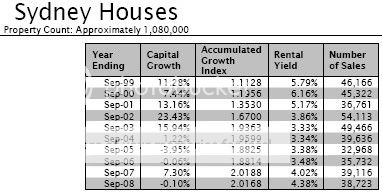

Thought you might be interested in these two pages out of an industry report we use to inform our senior executive in my company on the construction market economics. This report paints a scary picture around the level of housing commencements in the near future. It would be in their best interests to state otherwise given their audience, but they call it as they see it. Its a long report and in PDF so I can't post the whole thing, but it also models household net worth and house prices etc too. Lets just say that they don't see house prices falling much if at all...

I also can't see rents softening too much if those vacancy rate projections prove valid. That bottom graph on the first attachment is an interesting one don't you reckon? How is it that certain so-called "experts" always fail to model the impact of the underlying demand/supply equation when making price projections. Finance is only part of the picture...

Enjoy.

Cheers,

Michael

Thought you might be interested in these two pages out of an industry report we use to inform our senior executive in my company on the construction market economics. This report paints a scary picture around the level of housing commencements in the near future. It would be in their best interests to state otherwise given their audience, but they call it as they see it. Its a long report and in PDF so I can't post the whole thing, but it also models household net worth and house prices etc too. Lets just say that they don't see house prices falling much if at all...

I also can't see rents softening too much if those vacancy rate projections prove valid. That bottom graph on the first attachment is an interesting one don't you reckon? How is it that certain so-called "experts" always fail to model the impact of the underlying demand/supply equation when making price projections. Finance is only part of the picture...

Enjoy.

Cheers,

Michael