Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Some nice Supply Side numbers and charts

- Thread starter MichaelW

- Start date

More options

Who Replied?Hi Gools, thanks for the charts - that's a close fit, but not quite a match to any of my sources. Where's it from?

Where did you get 22.950? sure it is not 2,2295 mil person difference? I guess if we consider 8 mil household (or homes) X 0.27 = 2,16 mil extra persons you can squeeze in with the Shadow occupancy rate of 2.76

anyone of you maths wizz's got the correct fomula?

Its from RPData's Property Pulse news letter. Property Pulse 21/10/2008Hi Gools, thanks for the charts - that's a close fit, but not quite a match to any of my sources. Where's it from?

Makes for interesting reading most weeks.

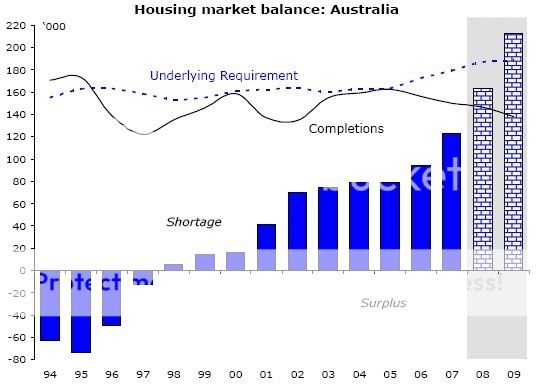

Yep, Wonder if the underlying demand and house shortage crap is taken from RESIDEX crap data.

There are various sources...

http://www.ato.gov.au/budget/2008-09/content/Overview/download/Budget_Overview.pdf

They had some pretty property graphs in the local Townsville Bully just recently, land sales down 60-70%, house sales down 60% on previous year and those numbers were first half of this year I suspect it will look alot worse by years end, Property section is now probably the heaviest part of the paper full of homes for sale, im no property expert but to me it appears the only shortage/undersupply out there atm is of buyers.

ANZ economist says prices will remain high. Well, not quite (I was there) but close enough.

And yet, people in ANZ who watch property risk for a living decrease maximum LVR to 90%.

Simple difference is who has skin in the game. ANZ economist gets it wrong, Shadow needs to find a new PowerPoint. Risk manager gets it wrong, risk manager gets fired.

And yet, people in ANZ who watch property risk for a living decrease maximum LVR to 90%.

Simple difference is who has skin in the game. ANZ economist gets it wrong, Shadow needs to find a new PowerPoint. Risk manager gets it wrong, risk manager gets fired.

Homeless people? Please try to think outside the box Foundation.

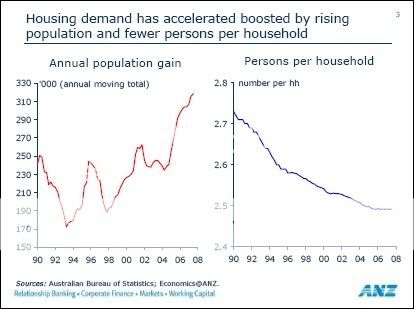

The number of persons per dwelling in Australia dropped from 2.97 in 1991 to 2.76 in 2001 and to 2.74 in 2006. So after falling considerably over a decade, this metric has basically flat-lined from 2001.

Who's to say the trend must be linear towards zero? Obviously it will flat-line at some point. I would suggest it would flat line above 2.

I'd suggest that maybe the reason why it has flat-lined are indeed the reasons you often cite for the next house price boom, namely a 'mini baby boom' and immigration. Immigrants tend to live in denser households than people born in Australia and an increase in birth rate will increase the size of households. There may also be a natural limit which we have approached. I see no analysis proving what the desirable occupancy rate of households is.

Bear in mind also that 1991 was a recession year and may be a statistical anomaly rather than indicative of any trend.

Using your analysis to deny existence of any oversupply is rather flakey at best.

Immigrants tend to live in denser households than people born in Australia

Got any stats to demonstrate this?

Using your analysis to deny existence of any oversupply is rather flakey at best.

To me the strongest evidence of under-supply is the record low vacancy rates.

As many stats as you have to prove that the household occupancy rate should trend ever lower. It's conjecture, but from my experience, people arriving from overseas tend to live more densely than Australians.Got any stats to demonstrate this?

My other point on the 'mini baby boom' still stands.

To me the strongest evidence of under-supply is the record low vacancy rates.

Which are debatable depending on the source.

What proves otherwise is the ever-increasing sales inventory.

That is a separate issue to people being able to afford property. The simple point is the more property increases in price the less demand there is for it.

You dont need to show a million graphics and google links and over analyse every minute point of things to know property prices arent going anywhere for a long time, most likely falling in price in the short/medium term and now is not a good time to buy.

Common sense can tell you that stuff. A lot of people have made a lot of money from property investing without going into the minutiae of property investing analysis seen on here. There is no need for it, except to attempt to win some esoteric, academic argument.

Common sense is worth a thousand of graphics, links, spreadsheets etc. What ever happened to common sense?

To me the strongest evidence of under-supply is the record low vacancy rates.

You dont need to show a million graphics and google links and over analyse every minute point of things to know property prices arent going anywhere for a long time, most likely falling in price in the short/medium term and now is not a good time to buy.

Common sense can tell you that stuff. A lot of people have made a lot of money from property investing without going into the minutiae of property investing analysis seen on here. There is no need for it, except to attempt to win some esoteric, academic argument.

Common sense is worth a thousand of graphics, links, spreadsheets etc. What ever happened to common sense?

Hi Evand,You dont need to show a million graphics and google links and over analyse every minute point of things to know property prices arent going anywhere for a long time, most likely falling in price in the short/medium term and now is not a good time to buy.

I actually tend to agree with what you've said above. I agree that households are likely to improve their balance sheets as the RBA eases rates instead of speculating on properties to drive prices higher. Fear rules for now, and prices are set to soften for the next couple of years.

However, I don't think the next couple of years translates to "prices aren't going anywhere for a long time". I'd call that a fairly short time unless you're suggesting we'll have a lost decade like Japan which I don't believe will happen.

Also, short term property price direction is only one factor when considering when to buy. So, linking the price projection to "now is not a good time to buy" is a flawed argument. I'd suggest that now is a great time to buy if you're building a solid portfolio to hold for the next upswing. You can buy well due to the gloom and actually buy CF+ if you look hard enough. With rates set to fall further, why wouldn't you buy CF+ today?

I try not to over-analyse the market but I do look at the broad drivers of long term price. I agree that short term fear and credit rationing may play a part in holding prices back and probably driving some price erosion. Even if we fall 20% I wouldn't be concerned as that's a whole lot less than the 100% growth experienced through the last property price boom. But long term the drivers are still there for solid price and rental appreciation which is why I started this thread. Of course, I knew there was a risk the short term horizon "speculators" would override the argument and look at the immediate environment and run all sorts of demand side arguments. But that doesn't diminish the long term argument.

Unfortunatly, there is a lot of investors, or those that like to attack investors but don't actually invest themselves, who can't see beyond the next couple of years. We're in a business cycle, no two ways about it, but its not the end of the world. 2010 and you'll all look back and wonder why you didn't look at the underlying market dynamics and buy up big when doom ruled and prices were such that you could buy CF+.

But that's just me. If you're speculating on prices next year or the year after then ignore everything I say as that's not my investment timeline. I'm building a large portfolio to provide an income stream in retirement. My focus is on yield and cash flow and not on short term price appreciation/depreciation. That's for the speculators and end-of-the-worlders.

Cheers,

Michael

You must spread the love before giving it to MichaelWhyte again

Very well said Michael.

I too am thinking long term, i really dont give a stuff what happens in the next year or two... im thinking about the 5 year, 10 year and 15 year time frames, and what I can do now to set myself up for then.

Thanks for sharing

Michael, you're so verbose.

With the price falls that are ahead of us on top of the decreases we have already seen. I think its going to be a long time before we see prices at any previous high. Let alone above that.

The simple fact is property is still historically high by any measure. (yield, wage multiples etc etc) and wont be doing anything exciting for a long time.

Whats a long time? 5-10 years i'd say.

By the way, dont rely on yield as a driver for prices, for 2 reasons.

1. It took the best part of a decade for increasing yield as the catalyst to increase property prices in the 90s. I think this is because yield cant move much beyond wage growth in the long term. We have a similar situation now.

2. I have already seen evidence of rents dropping in Sydney's inner West (Sydney's rental hot spot). Spoken to a couple of agents and they say 'demand has dropped off a bit lately'. So much for under supply of property.

There's is only under supply if prices (rent & purchase) are ok. When it gets too expensive demand drops right off.

With the price falls that are ahead of us on top of the decreases we have already seen. I think its going to be a long time before we see prices at any previous high. Let alone above that.

The simple fact is property is still historically high by any measure. (yield, wage multiples etc etc) and wont be doing anything exciting for a long time.

Whats a long time? 5-10 years i'd say.

By the way, dont rely on yield as a driver for prices, for 2 reasons.

1. It took the best part of a decade for increasing yield as the catalyst to increase property prices in the 90s. I think this is because yield cant move much beyond wage growth in the long term. We have a similar situation now.

2. I have already seen evidence of rents dropping in Sydney's inner West (Sydney's rental hot spot). Spoken to a couple of agents and they say 'demand has dropped off a bit lately'. So much for under supply of property.

There's is only under supply if prices (rent & purchase) are ok. When it gets too expensive demand drops right off.

That's where we disagree. Inflation isn't dead, only subdued. Once China kicks into gear to avert a global recession, today's calamities will seem like yesterday's news.With the price falls that are ahead of us on top of the decreases we have already seen. I think its going to be a long time before we see prices at any previous high. Let alone above that.

Concise enough?

Cheers,

Michael

As many stats as you have to prove that the household occupancy rate should trend ever lower. It's conjecture, but from my experience, people arriving from overseas tend to live more densely than Australians.

I am an immigrant from Ireland. For the past nine years there have been two people in my household. This increased to three people 8 weeks ago!

Which are debatable depending on the source.

Regardless of source, we should look at trends. If we use the same source then we can identify trends over time. All the sources I can find show a drop in the vacancy rate over the past few years. So unless you believe their methodology has changed recently, we can reasonably conclude that the vacancy rate is trending lower.

You dont need to show a million graphics and google links and over analyse every minute point of things to know property prices arent going anywhere for a long time, most likely falling in price in the short/medium term and now is not a good time to buy.

Common sense can tell you that stuff. A lot of people have made a lot of money from property investing without going into the minutiae of property investing analysis seen on here. There is no need for it, except to attempt to win some esoteric, academic argument.

Common sense is worth a thousand of graphics, links, spreadsheets etc. What ever happened to common sense?

Common sense tells me this...

- Property prices in Sydney are down 15% from their peak and have moved backwards for half a decade.

- The falling Australian dollar has made Australian property up to 40% more affordable for foreign investors.

- The price gap between Sydney and other cities is now quite small by historical standards.

- FHOG increased to $24K in NSW.

- Interest rates are plummeting.

- Rental vacancy rates are at historic lows and rental yields are rising.

- Many properties are now cashflow positive, could soon be cheaper to buy than rent.

- The population is growing very strongly.

- Banks are still keen to lend.

- Sales volumes are as strong as ever.

Common sense tells me it is a good time to buy property in Sydney.

Cheers,

Shadow.

I am an immigrant from Ireland. For the past nine years there have been two people in my household. This increased to three people 8 weeks ago!

See, you immigrants tend to prefer to live in higher than average occupancy rates. For years you lived below the average, which only built up a lot of pent up demand.

Thanks for proving my point.

See, you immigrants tend to prefer to live in higher than average occupancy rates. For years you lived below the average, which only built up a lot of pent up demand.

Thanks for proving my point.

Huh?