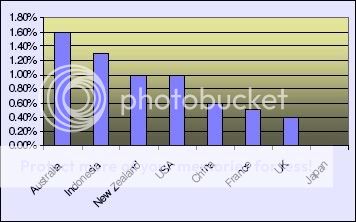

Yet strangely not that much stronger than NZ population growth, which has enjoyed a strong commodity boom recently, and is also heading for a recession and house price correction.

Not much stronger? What... 60% is 'not much'?

Australia has a housing shortage, whereas NZ has a surplus.

Approx 2500 kiwis per month are permanently moving to Australia (double the rate of two years ago).

NZ has had nothing like the terms of trade boost that the commodities boom has delivered to Australia.

Australia has a much stronger budget surplus than NZ, and it is forecast to be even stronger in the future.

Australia's real GDP is forecast to increase by 2%+ in 2008-09, while NZ is forecast to increase only by 0.5%.

The NZ drought has slashed their farm production, their primary export market.

NZ probably will have a house price correction, as will some cities in Australia, as did Sydney from 2004-2008.

But this is not the big crash that you D&Gers are holding out for. Not yet.

You'll have to wait until after the next boom.

I often see the D&Gers say 'we're just like NZ' or 'we're just like UK and USA'.

But we're not. There are significant differences between Australia and NZ, UK, USA, Spain etc.