Hi, See_Change and all:

Honestly, my IP knowledge is from this forum. I have no problem to share my IP details in Adelaide with everyone as well as the decisions behind it.

My background:

Firstly, I have 10 IPs (houses and many of them having development potential) in Sydney with heavy land tax.

So, I move to Brisbane to buy 4 houses with one in Salisbury with land area of 956 square meters. So, I don't need to pay land tax with my wife holding two and I have two.

In any major city, if the area having 5 years down time, the risk to buy in this area is much lower than the last 5 years.

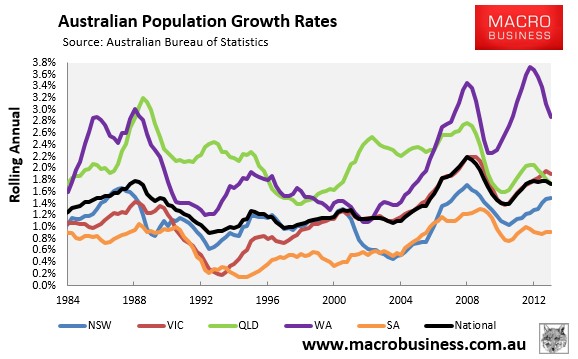

Now, Adelaide property market is down for 5 years and its property yearly growth is similar to other cities. And it is (will be) free to hold (good return) on the properties with good tenants. I hate to buy into areas like Mt Druid which I have so much head with one property before. Please note that many people are successful in buying those areas with their special skills or local knowledge.

There are some limitations on my interstate buying:

I am more conservative such as requiring low maintenance.

I don't bother development potential in Adelaide as it is simple too cheap. Why bother to rebuild?

With so many properties on my holding, good rental return is the key for my Adelaide's purchase.

I always like to buy houses as well in the reasonable areas with good tenants.

I have my own management agent to inspect or give my second opinions on every decision.

And I know I will always pay a little more in the prices as I can't afford to fly there many times.

Finally, I haven't been Adelaide before. So, please discount my contribution here.

The properties I bought over there are

41 Winnerah road, Christies beach - A$282K - A$280/week. -> I would like to retire in this house within 10 minutes walking distance to the beach.

Actually, I missed one house in Hackam West of "A$225K/A$270week" while I fly there. So, I decide to buy this little blue chip house instead. There were few offers at the similar prices at that time.

22 Osmund St, Christie downs - A$225K - A$280/week. -> good return

No competition at all in open market on this house for 2 weeks.

9 Lutana Ct, Morphett Vale - A$248.5K - A$280/week

This one was't in the open market at all and I don't bother to fly over to inspect it.

However, there are some facts in the history of this property (can't remember the exact details):

1. The last owner was paying about A$75K, for around 15 years. Can you see the capital growth here?

2. The tenants lives there for something 10 years. It means the house must be good.

3. The rent was about A$160/week at 7 years ago. Rental increase is healthy too.

4 months passed after purchased them, I have no issues with all tenants. Every fee is half price, comparing to Sydney, from water rate, council fees and insurance fees.

Actually, no issues in Brisbane's ones and Sydney's ones as well.

I just feel Adelaide market is still depressed without to much competition. That is what I like the most in buying.

Only God will know when Adelaide market will move. However, within 10 years, I believe Adelaide market is much higher than today. With rental increase, it is free or will be free to hold them.