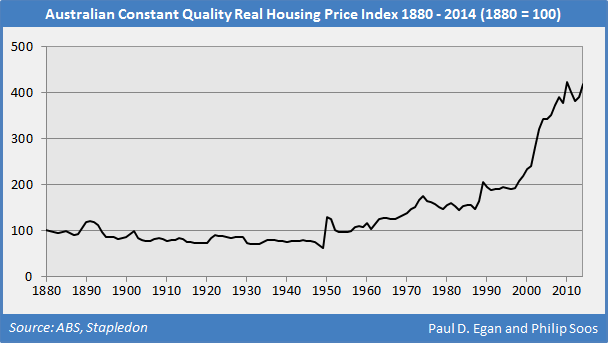

And looking at euros chart, yes house price growth through the 90s and early 2000s is a simple move for Australia from an 'low debt economy' to a 'high debt economy' driven by financial deepening/liberilisation.[/QUOTE]

oops- wasn't my chart

I was just commenting on it and pointing out that the timelines correspond perfectly with;

1. deregulation of banking - someone may want to check when Rabobank, ING, HSBC, Citi etc started doing business in Australia. This was the start of competition and much lower rates and new landing policies.

2. securitisation - someone may want to check when Aussie, Wizard, Rams etc came to be each capital growth phase. This was a continuation of competition and much lower rates and new landing policies.

3. LMI - total game changer. 20% deposits no longer required. First came 90/10's in the very early 90's. Then came 95% , then came non gen savings..then came lo doc, no doc .... and so it went.

All equating to.... BOOM time

I interpret freckles to be saying something very sensible; the expansive lending/credit environment has run its course. It actually ran its course on the rest of the planet 6-7 years ago. Canada and Australia are the two real exceptions, where LVR's werent curtailed to 80% and prices plunged rapidly.

The point is, LVR's have maxed out. They have nowhere else to go. There is no appetite in the RMBS market for no docs or traditional lo docs, or 5% non gen savings, or 100% or 105% LVR's - not anymore. GFC saw an end to that. Todays LVR's as as good as it will be for years, possibly decades. And the issue there is that mature investors may have equity, but people starting out cant manufacture it as quickly as mature investors could - because the truth is- investors didnt manufacture it - lending policies did.

Now, with all due respect, those of you who don't know your way around bank servicing policies nor the realities of how banks actually fund residential mortgages and who have only ever known property to go up, up, up should at least be willing to acknowledge that you need more and more buyers able ( notice I didnt say willing) to pay more and more money in order for prices to continue to rise. And for that to happen at the accelerated rate it happened at during the 90's and 00's, simply isn't possible - because the 3 points listed above are already fully exhausted, so now the ONLY thing creating capacity is big rate cuts. When those are done, so will this bull run.

How do I see it all unfolding? Oh who knows...but I suspect if no more rate cuts come along, we are probably into the last part of this run - and this run hasnt been nationwide this time - which is the first time ! The boom in the 90's and 00's took everyone along. The mini boom post GFC ( off the back of big rate cuts and stimulus) ran much shorter and took all cities along - but this one is even shorter and hasnt spread as wide. tell you anything?

Anyway it's probably reasonable to speculate that we will likely see prolonged period of CPI type growth. I certainly don't see a calamity coming - that would require a huge rise in unemployment and banks facing serious difficulty in the RMBS markets because of large arrears and defaults - which in Australia is unlikely because we have Genworth and QBE sitting astride all 80% + deals. Possible? sure. Likely - not so much.