Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Housing Finance Commitments Up Strongly

- Thread starter Shadow

- Start date

More options

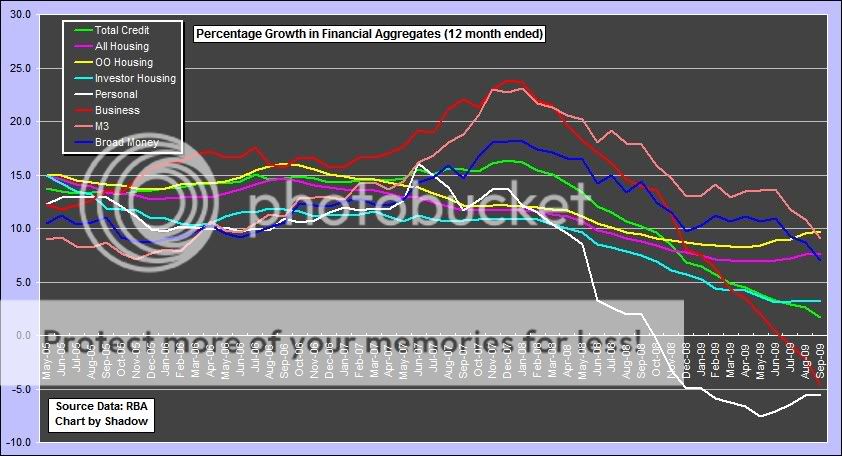

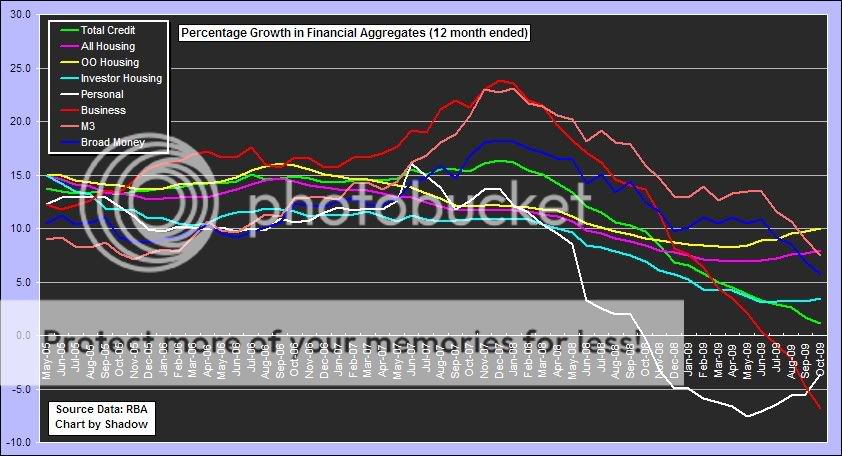

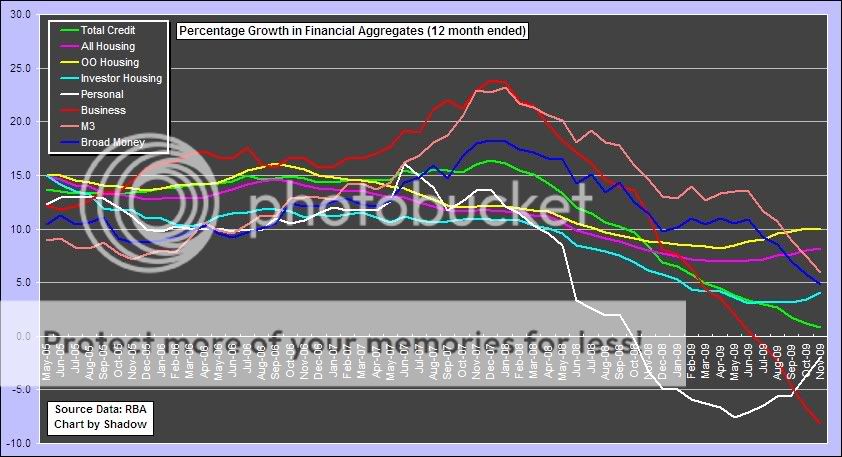

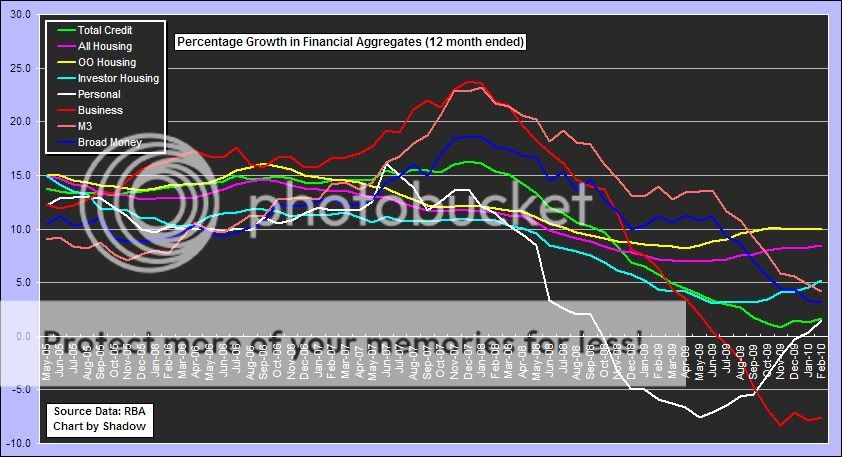

Who Replied?That red line is a terrible leading indicator. As is the amount of total credit heading south in a big way. Will be interesting to see how all this plays out but at the moment you would have to conclude the prospects for growth aren't looking good from a business perspective. The RBA can't ignore that forever.

Any property investor who doesn`t turn a whiter shade of pale when really taking a look at the Aussie and US graph, needs to put on their helmet and pack up thier crayons.

Business lending still looks very unhealthy.

Shadow, too true...

But some lead indicators suggest that this might also be about to turn:

Businesses planning to restock on high sales expectations

SMH said:Australian businesses are planning to restock inventories as confidence in the economic turnaround continues into 2010, a survey shows.

Sales expectations for the March quarter have reached the highest level in six years, a Dun & Bradstreet business expectations outlook for the March quarter has found.

Expectations for growth in inventories are also up, at the highest level in more than four years, climbing one point to an index of five compared to the December quarter.

Sales and profits expectations showed an index rise of two points for sales and a rise of three for profit expectations while selling price expectations have fallen to an index of nine, the lowest level ever recorded during the survey's 21 year history.

Employment expectations also fell four percentage points to an index of zero while 31 per cent of firms reported a negative impact from credit card market conditions, showing a fall of six per cent.

Four per cent of executives expect wages growth to be the most significant influence on operations, while 19 per cent plan to reduce their current business debt levels in the upcoming quarter.

But the above suggests despite plans to invest in inventories, they're going to reduce debt. I think they're tapping the equity markets pretty hard at present and using surplus cash flows to fund operations due to their high cost of capital.

This also:

Sydney job ads surge in January

Looks like the economy is on the mend and businesses are re-investing. They're just not using debt as much as they used to in order to fund their operations. The banks will like this as they rebalance their balance sheets to have more boring old secure mum and dad property borrowers on their books at a lower risk rating than commercial loans. Helps with their Basel capital adequacy reporting based on the risk weighting of their assets which favours the property assets over commercial. Won't help when Basel introduce their absolute leverage ratio measure in the near future though where all assets are considered equal as it is currently proposed. Here's a nice article on the issue if you're interested:

Nordic banks feel the chill

Cheers,

Michael

and Down

From the Australian

http://www.theaustralian.com.au/bus...ses-end-of-grant/story-e6frg9gx-1225816385452

From the Australian

http://www.theaustralian.com.au/bus...ses-end-of-grant/story-e6frg9gx-1225816385452

THE Reserve Bank's three consecutive rate rises and the winding down of the first-home buyers' grant have knocked the stuffing out of the housing market, with sales of new and established homes weak at the end of the year.

There was a 21.2 per cent fall in applications for new mortgages in December, according to Australia's biggest mortgage broker, Australian Finance Group.

Sales of new houses and apartments in November by members of the Housing Industry Association were 10 per cent below the peak touched in August.

"Three rate rises in a row was overkill for a vulnerable market, and the latest figures confirm our fears," AFG general manager Mark Hewitt said yesterday. Mr Hewitt said December was traditionally a slow month for housing sales, but the latest fall compared with a drop of 8 per cent in December last year.

Hi people

This is where I have problems with all the upbeat figures thrown about because as in Julie's article , you then turn around and see the complete opposite in other more realistic numbers .

I mean where do all these people get their stuff from ,every set's totally different.

My caution is in that when ever you see any real numbers as in that article , numbers are actually way down , not up. And for numbers to actually still be down after all that money thrown at them , something's way a miss ! Add our housing price ratios compared to other countries crashing yet on a much lesser ratios, plus our biggest boom ever , well ! Where would 09 have gone without those billions , and if it was that simple then no one would have crashes, someones telling porkies .

Wouldn't it be handy if just for once , they all said the same thing .

Cheers

This is where I have problems with all the upbeat figures thrown about because as in Julie's article , you then turn around and see the complete opposite in other more realistic numbers .

I mean where do all these people get their stuff from ,every set's totally different.

My caution is in that when ever you see any real numbers as in that article , numbers are actually way down , not up. And for numbers to actually still be down after all that money thrown at them , something's way a miss ! Add our housing price ratios compared to other countries crashing yet on a much lesser ratios, plus our biggest boom ever , well ! Where would 09 have gone without those billions , and if it was that simple then no one would have crashes, someones telling porkies .

Wouldn't it be handy if just for once , they all said the same thing .

Cheers

"Economic forecasting makes astrology look respectable" - or words to that effect (from Bernanke, Greenspan, Friedan or one of those ilk)

I posted somewhere else I think, that a study of the economic forecasters showed that their consensus view (presumably when the 'ayes have it') has an eighty percent success rate over time - so the consensus that the world is moving to recover (the general consensus) is 80 percent probable.

All predictions I've seen for Australia indicate the consensus is for continued growth - 80% chance that view is correct - now if you're talking 2011 then we'll need a new consensus.

I posted somewhere else I think, that a study of the economic forecasters showed that their consensus view (presumably when the 'ayes have it') has an eighty percent success rate over time - so the consensus that the world is moving to recover (the general consensus) is 80 percent probable.

All predictions I've seen for Australia indicate the consensus is for continued growth - 80% chance that view is correct - now if you're talking 2011 then we'll need a new consensus.

Hi Julie.

Yeah you'd think that would have to be a pretty reliable way of looking at it then wouldn't you.

I'd have to say though most experts were saying our stock market was heading for 7 in 09 , bar a few , so I wish it was that easy.

And then the same saying early 09 , it could be a 5 yr recovery.

Or the Packers that lose billions in the Las Vegas's of the world, but who can afford and use the best advice in the world, only to dump the lot 6 mths later , vedy confusing !

I'm a bit like you and read both sides , hopefully sifting through to where I feel the the most logical scenarios are from those.

Cheers

Yeah you'd think that would have to be a pretty reliable way of looking at it then wouldn't you.

I'd have to say though most experts were saying our stock market was heading for 7 in 09 , bar a few , so I wish it was that easy.

And then the same saying early 09 , it could be a 5 yr recovery.

Or the Packers that lose billions in the Las Vegas's of the world, but who can afford and use the best advice in the world, only to dump the lot 6 mths later , vedy confusing !

I'm a bit like you and read both sides , hopefully sifting through to where I feel the the most logical scenarios are from those.

Cheers

Latest chart... property investors still appear to be returning...

property investor lending increased around 3 BIL$ to 327.6 bil$, for the last few months the increase was a couple of bil$ a month.

M3 and other money number looks in better shape despite the increase in rba interest rate, offshore borrowing also is stabilising after the big rise in january.

In any case, banks are lending more and more and they increased loans by another 10 bil$ in february to a whoopping 1.5 tril$ (and 1.65 tril$ for all financial institutions), total home lending is at 1.1 tril$

Interesting chart - thanks Shadow.

I wonder what the neutral level of credit growth is for housing. It's not that much higher than it was in 2008 (when prices were falling), and yet most of Australia has double digit rises at present.

Investors seem to be coming back, but not in huge numbers. And the market looks very flat - could housing credit be about to drop off?

I'm also curious what the neutral level is in terms of the growth of lending to be reflected in rising prices. (i.e. How much of the growth in lending is down to re-mortgaging or re-financing properties, and how much is from buyers entering or moving up the market.)

What I find most worrying is that business lending is down, and I'm not sure if it's starting to turn around, or just bumping along the bottom. This should be what drives growth, and if it's not being supported then the economy could contract, and that's not a fun experience.

I wonder what the neutral level of credit growth is for housing. It's not that much higher than it was in 2008 (when prices were falling), and yet most of Australia has double digit rises at present.

Investors seem to be coming back, but not in huge numbers. And the market looks very flat - could housing credit be about to drop off?

I'm also curious what the neutral level is in terms of the growth of lending to be reflected in rising prices. (i.e. How much of the growth in lending is down to re-mortgaging or re-financing properties, and how much is from buyers entering or moving up the market.)

What I find most worrying is that business lending is down, and I'm not sure if it's starting to turn around, or just bumping along the bottom. This should be what drives growth, and if it's not being supported then the economy could contract, and that's not a fun experience.

Last edited:

Wouldn't bet on that, When Japan dropped the rates in early 90's they probably also thought it was for dire circumstances, well they are still sit at zero interest rates and Japan credit is still not expanding.

USA also is sitting at zero and credit is still expanding comparing to gdp, but it is at slowest pace in a very long time (mainly because gdp is shrinking). Australia "expansion", as you can see from shadows chart is not particulary strong and mainly also because of gov stimulus then rates.

I am not saying australia will stop expanding as well, but it is far from granted that will decouple from other major countries, specially on the interest rates.

well looks like the proof is in the pudding.

Interest rates have moved up and will CONTINUE to move up, until at least 5%.

The RBA has been quite explicit about this. And further more i think they are very correct in doing so.

If things do go pear shaped in the future at least the RBA will have the ability to drop them again (from this higher base). But its harder to drop when you are already operating on expansionary interest rate settings.

when do you think Japan had a recession before the end of 80's? was very much like australia now and most people thought they were going to rule the world, decoupling from everyone else, running massive gdp increases every year forever etc.

the data say Japan total debt is decreasing and soon will be less then Australia.

About the saving rate or savings in general you can get a broad idea by: total debt going up against gdp no much savings in place. If you want to study deposit and money flow more in detail you can check the RBA financial aggregate where also Shadow got the data for his chart.

You can see M1 (currency + deposit stand at 251.2 bil$, offshore borrowing at 311 bil$ (and we even have a strong AU$ and those borowing are mainly in US$), then you can do a bit of study yourself comparing this data with M3, and you should do it for the past few years at least, etc.

Then, after you finish can you clarify what do you mean with this statement:

I didnt need to look at all this statistics you quoted. It was quite plain in 'fed speak', as simple as read my lips.

Interest rates are going to at least a neutral setting. A neutral setting is 5-6%. Adjustments will be made for increased bank margins, but this is the neutral zone.

Now maybe the RBA increases again in april and maybe they dont, i think its its not too important to guess correctly either way, they have made it very plain where their end target lies based on current information.

"Economic forecasting makes astrology look respectable" - or words to that effect (from Bernanke, Greenspan, Friedan or one of those ilk)

I posted somewhere else I think, that a study of the economic forecasters showed that their consensus view (presumably when the 'ayes have it') has an eighty percent success rate over time - so the consensus that the world is moving to recover (the general consensus) is 80 percent probable.

All predictions I've seen for Australia indicate the consensus is for continued growth - 80% chance that view is correct - now if you're talking 2011 then we'll need a new consensus.

This might be true, but consider when you are buying a property you are buying an illiquid asset with high transaction costs. Therefore you need to give due consideration to an economic time frame greater than one year.

Interesting chart - thanks Shadow.

I wonder what the neutral level of credit growth is for housing. It's not that much higher than it was in 2008 (when prices were falling), and yet most of Australia has double digit rises at present.

Investors seem to be coming back, but not in huge numbers. And the market looks very flat - could housing credit be about to drop off?

I'm also curious what the neutral level is in terms of the growth of lending to be reflected in rising prices. (i.e. How much of the growth in lending is down to re-mortgaging or re-financing properties, and how much is from buyers entering or moving up the market.)

I don't have alla the exact data handy but you can get a lot of information with some simple matematic operatio.

For example In australia there are around 9 mil homes with the average price of 450k it comes up to around 4 tril$, so a 12% home price increase for last year put around extra 400 bil$ in home owner equity, home lending in the last year increased around 90 bil$, new homes were around 100.000? average first home loan around 250k$? that would make 25 bil$ loans for new homes, so, probably 65 bil$ are the equity taken out from existing homes that is probably in the range of 10 to 20% using 2009 money value, then you have to consider we had 2 to 3% cpi increase and similar wage increase. Probably assuming a net 10% of the increased equity in homes was spent is not far off reality. Those money spent was boosting gdp and supporting further home prices rises.

It is like a vicious cycle that can stop tomorrow or in 10 years time, but you can see that the house is always the same and phisically there, but, in the long term you can't take out infinite debt out of it.

I didnt need to look at all this statistics you quoted. It was quite plain in 'fed speak', as simple as read my lips.

Interest rates are going to at least a neutral setting. A neutral setting is 5-6%. Adjustments will be made for increased bank margins, but this is the neutral zone.

It make me smile when I see economists talking to neutral level of interest rates, even those working at RBA, I think they know it is very short minded talking, but it is a easy explanation of their actions.

To prove it is crap just analyse what was a Japanese neutral interest rates in the 80's? over 5% for sure, what was neutral in the 90's? 0 to 1%!

For Australia, what is the neutral interest rate if commodity prices goes up 20% a year and what is the neutral rate if they drop 20%? also, what is the neutral rate if home prices rise 10% and what if they fall 10%?