For Australia, what is the neutral interest rate if commodity prices goes up 20% a year and what is the neutral rate if they drop 20%? also, what is the neutral rate if home prices rise 10% and what if they fall 10%?

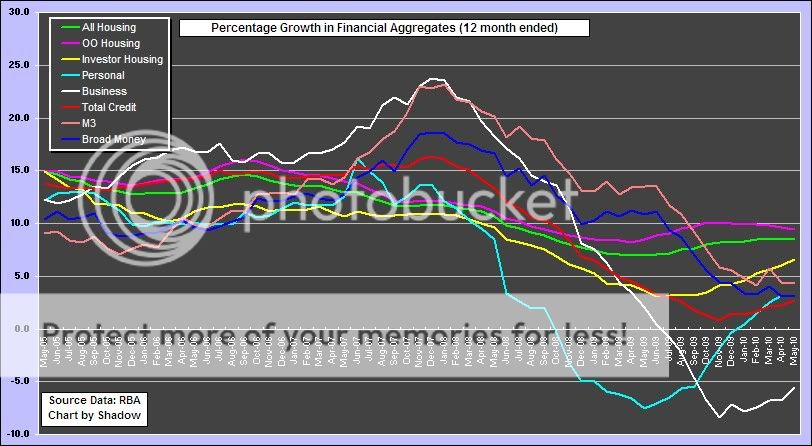

Very good point, boz. "Neutral" settings to cool off house price inflation will not necessarily be a good setting for the wider economy. I'm with Graemsay in so far as noticing the pitiful business lending "growth." From where I sit there is definitely no exuberance in the manufacturing sector. I saw in The Age this morning that it's become extremely difficult for job seekers in Victoria. I've heard before that small business is the "economic engine" of the community. Its optimism is a precondition of employment growth and other than the blip before the year end tax concession, business is not borrowing.

I don't know how much of this still due to lack of credit. I suspect it's largely due to caution and rightly so. You'd want to see a strong return of demand before even considering upping your gearing in this climate. The media has been way too quick to overplay the "business confidence returns" polls. 12 months ago business owners thought they were about to fall off a cliff. Compared with that of course a great percentage of them will now be "more" optimistic. But there's a long continuum between "fall off a cliff" and "gear up for extreme growth." We're not in Kansas yet.