Yep

See below for an update on RBA/APRA MP intentions..

Macroprudential is coming, it?s only a matter of time

Their intention seems to be rather than an LVR approach like NZ they'll go for stricter/tougher qualifying criteria with higher interest rate buffers.

Yes, but this is nothing unusual and has been used previously - for a brief period as part of the 02-04 boom before increases in rates 'took the top of off the boom'.

Lots of this 'macroprudential' stuff is going on behind the scenes without anyone ever really knowing. The mass media have no idea what they're talking about when it comes to macroprudential tools, they just love the word because its 'complexity' garnishes so much attention.

There's been a large shift in the international space towards their use - largely promoted by failures in supervision during the GFC and Asian economies preference for a 'hands on' approach. Maybe its just Governments trying to avoid raising interest rates (politically popular).

APRA's done a a world class job in this space over the last 2-3 decades, and have done it at a canter. The health of our financial system is seen as world leading and wasn't really exposed under the most testing conditions in decades.

Their approach to these sort of asset price booms are:

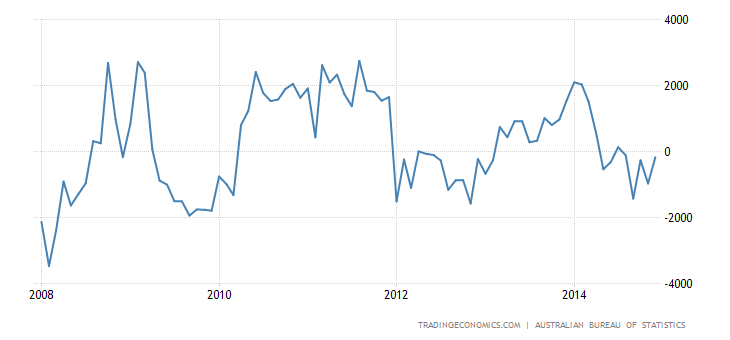

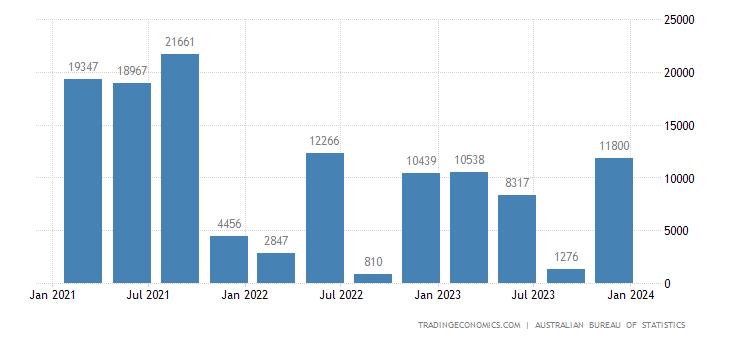

1) Watching whats going on. This involves playing close attention to all the banks. There's been an obvious build up of interest only investor driven credit - which is a 'red flag', so they'd be collecting data on this.

2) Counselling the banks that are waning in terms of prudent lending.

3) Providing prudential guidance. APRA recently sent out a 20odd pager on how banks should effectively lend. This is effectively a 'benchmark' or 'yardstick'.

4) Stress testing - they do this year on year. They're probably being a little more prudent in this domain given the 'frothiness' in the housing market.

5) Turning up the dial - digging into their toolbox. LVR rationing is way down the list. It also doesnt really target the specific risks building in Australia, and comes at large 'indirect' costs, e.g. first home owners, etc.

By the sounds of it they'll turn up the dial - the media seem to be alluding to that.

But that may be all happening BEHIND the scenes. If some of big banks start charging a 10-20bp premium for 80%+ loans, it wont be that unusual (ING/NAB for example do this already). Alternatively, some banks are now offering 'discounts' to go P&I - APRA motived presumably.

Cheers,

Redom