http://www.prosolution.com.au/news/anz-property-report.pdf

The October ANZ Property Outlook was released yesterday. It focuses on why Australia is different to the USA. Here are some of the key points...

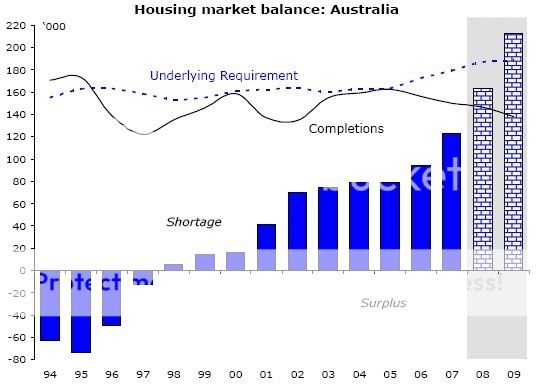

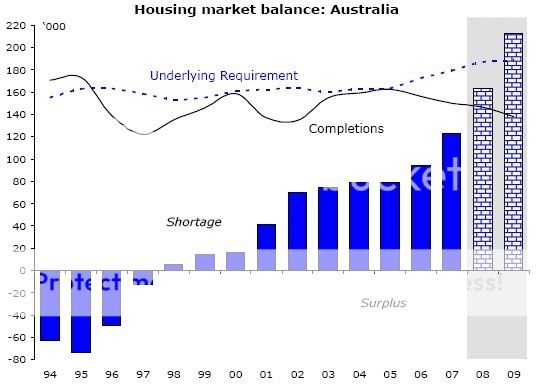

1. Australia does not have a physical excess supply of housing. America does, because unlike us, it actually built more new dwellings than it required to meet growth in underlying demand. In Australia, the reverse has happened: we haven’t built enough dwellings to meet underlying demand, which has been pushed up by rising levels of immigration.

2. The IMF specifically acknowledges that there is no evidence of a significant overvaluation of Australian house prices.

3. Australia does not have a huge supply of existing dwellings for sale at any price hanging over the market because of the huge increase in foreclosures that has been the primary source of downward pressure on American house prices.

4. There has been far less imprudent lending here than in America. "Non-conforming" loans (the closest thing we have to sub-prime) represent around 1% of all mortgages outstanding in Australia, as against around 15% in the US; while “low-doc” and “no-doc” loans account for around another 7% in Australia compared with about 15-20% of American mortgages being "Alt-A" which is their equivalent of “low-doc” or “no-doc”.

5. The RBA was one of the very few central banks which did not make the mistake (which the US Federal Reserve under Alan Greenspan in particular did make) of keeping interest rates too low for too long in the first half of the current decade. That's why proportionately far fewer Australians than Americans were enticed into taking out mortgages that they couldn't hope to be able to service when interest rates returned to more "normal" levels.

6. Mortgage lending in America is typically "non-recourse": that is, in the event of default, the lender can take possession of, and sell, the property against which the mortgage is secured, but cannot make any claims against any other assets or income which the defaulting borrower may have.

7. Default rates on Australian mortgages have remained vastly lower than on American ones - even though the interest rates which Australian borrowers have been paying have generally been somewhat higher than those paid by American (or British) homebuyers.

8. There are proportionately far fewer dwellings in foreclosure, and thus “on the market” for whatever price someone is willing to pay for them, in Australia than in the US, there has been far less downward pressure on house prices here than in the US.

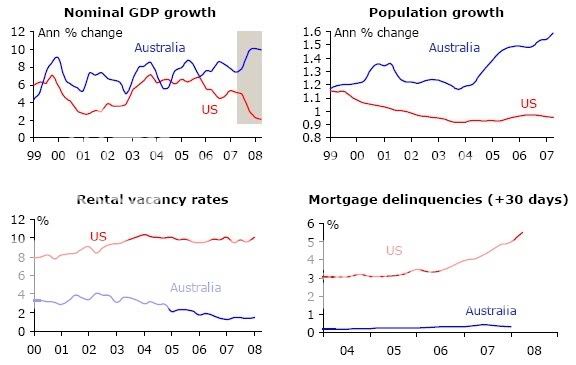

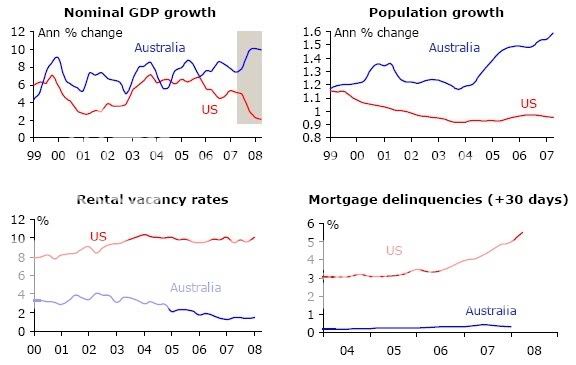

Some interesting charts from the report. These charts really highlight the positive differences between the US and Australian economy and property markets, especially that our GDP growth is much stronger, our population growth is 60% higher, our vacancy rates are one fifth of the US vacancy rate, and our mortgage delinquency rates are very low in comparison.

Cheers,

Shadow.

The October ANZ Property Outlook was released yesterday. It focuses on why Australia is different to the USA. Here are some of the key points...

1. Australia does not have a physical excess supply of housing. America does, because unlike us, it actually built more new dwellings than it required to meet growth in underlying demand. In Australia, the reverse has happened: we haven’t built enough dwellings to meet underlying demand, which has been pushed up by rising levels of immigration.

2. The IMF specifically acknowledges that there is no evidence of a significant overvaluation of Australian house prices.

3. Australia does not have a huge supply of existing dwellings for sale at any price hanging over the market because of the huge increase in foreclosures that has been the primary source of downward pressure on American house prices.

4. There has been far less imprudent lending here than in America. "Non-conforming" loans (the closest thing we have to sub-prime) represent around 1% of all mortgages outstanding in Australia, as against around 15% in the US; while “low-doc” and “no-doc” loans account for around another 7% in Australia compared with about 15-20% of American mortgages being "Alt-A" which is their equivalent of “low-doc” or “no-doc”.

5. The RBA was one of the very few central banks which did not make the mistake (which the US Federal Reserve under Alan Greenspan in particular did make) of keeping interest rates too low for too long in the first half of the current decade. That's why proportionately far fewer Australians than Americans were enticed into taking out mortgages that they couldn't hope to be able to service when interest rates returned to more "normal" levels.

6. Mortgage lending in America is typically "non-recourse": that is, in the event of default, the lender can take possession of, and sell, the property against which the mortgage is secured, but cannot make any claims against any other assets or income which the defaulting borrower may have.

7. Default rates on Australian mortgages have remained vastly lower than on American ones - even though the interest rates which Australian borrowers have been paying have generally been somewhat higher than those paid by American (or British) homebuyers.

8. There are proportionately far fewer dwellings in foreclosure, and thus “on the market” for whatever price someone is willing to pay for them, in Australia than in the US, there has been far less downward pressure on house prices here than in the US.

Some interesting charts from the report. These charts really highlight the positive differences between the US and Australian economy and property markets, especially that our GDP growth is much stronger, our population growth is 60% higher, our vacancy rates are one fifth of the US vacancy rate, and our mortgage delinquency rates are very low in comparison.

Cheers,

Shadow.