At a point in history where almost every other western country is experiencing asset price deflation due to a debt/credit crisis... who would 'hedge' their bets by purchasing rather expensive assets of the same class, especially with borrowed money.

It's better to sit on your hands some times.... difficult as that may be.

A fair point I reckon - something this guy seems to agree with

http://www.dailyreckoning.com.au/progressive-taxation-was-never-about-fairness/2009/05/13/

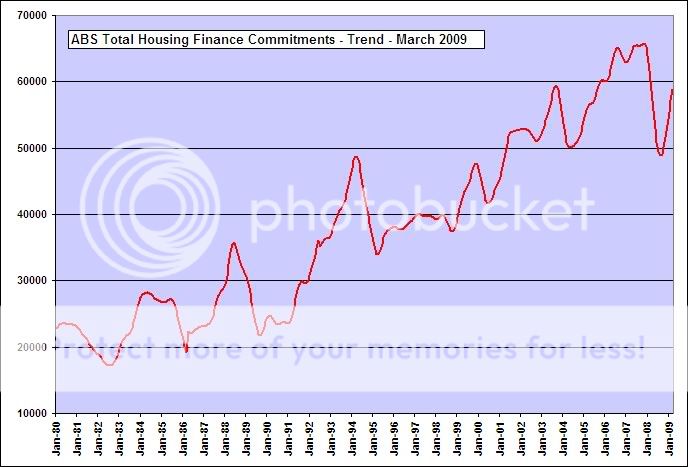

Interesting graph too!

In other budget news, the $21,000 first home buyer's grant for newly built properties has been extended past June 30th to September 30th. The $14,000 grant for existing homes has also been extended to September 30th. Between October 1st and December 31st, the grants will be reduced to $14,000 and $10,500 respectively. And next year, they will revert to measly $7,000 figure for each that John Howard set when he introduced the subsidy to the real estate and building industries in 2000.

Both the Howard and Rudd governments will rue the day they subsidised higher house prices with government handouts. It's going to impoverish a whole generation of Australians, making them house poor and mortgage-debt rich. Why?

House prices do fall. They don't double automatically every seven years. If we had a three-bedroom house for every time we heard that in 2004 we'd be incredibly house rich. In the U.S., the National Association of Realtors reported that median U.S. house prices fell 14% in the first quarter of 2009 compared to last year. Existing home sales also fell by 6.8%

It was the largest quarterly decline in U.S. house prices ever reported. Of the 152 metropolitan areas surveyed, prices fell in 134 of them. The price declines were especially shocking in places where the boom was greatest In the Cape Coral-Ft. Myers area of Florida, prices fell 59%. In Saginaw, Michigan they fell by 54%. In Akron, Ohio they fell by 48%. And in San Francisco, they fell by 43%.

There are people who tell you those sorts of declines could never happen in Australia. But those people are morons. A contraction in bank lending, a rise in unemployment, a restriction on immigration, and a rise in interest rates remove all the props that have supported the soaring Aussie property market up until now. If you don't think it can happen here, you're kidding yourself. And if you disagree, send us a note at [email protected] and tell us what you think of the chart below.

Source: www.whocrashedtheeconomy.com