OMG , I missed one .... Must be slipping

Thanks mate

Cliff

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Each Cycle is peaked by a period of irrational exuberance , where people will say " oh my gosh, that sold for ....... " . In 2004 , friends sold a house in a particular area of turramurra for close to 2 mill . That was our reaction . If that house sold at this stage , it might just get that price again , and that's give that the market has gone up around 20 % as a whole since then.

There will be a correction . Just not yet ......

If you're timing cycles, then time to sell (Sydney) is probably now.

Yep, fair enough or that.Or extract Equity

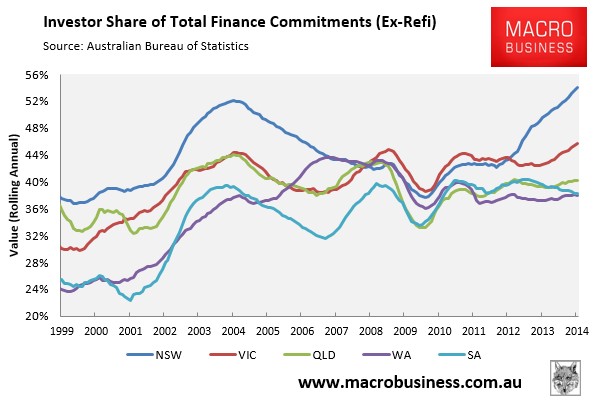

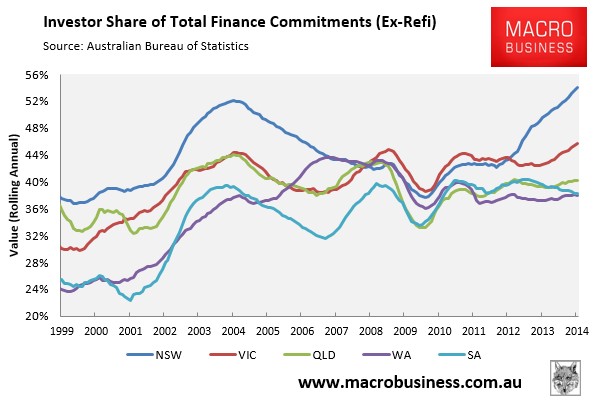

The home buyers lined up for land is one sign we are already there, as is the market share that investors are blindly buying up:

http://www.macrobusiness.com.au/2014/07/sell-sydney-property/

RP Data chart showing rate of growth likely to have peaked, indicating price peak also near and decline to come...

If you're timing cycles, then time to sell (Sydney) is probably now.

let's hype the sydney market thread

It's from this RP Data update: http://somersoft.com/forums/showthread.php?t=101667Do you have an SA graph or where can I find them? thanks

Why does sydney need hyping when it's doing the job?

Look see change this is good for sellers but how is it sustainable with all things considered?

Just saying,i'm postive but the future line looks a tough road and a lot of walking backwards.

Kind regards Shovelhead.

Does anyone have statistics on the demographic of people buying in Sydney at the moment and how they are financing?

This wave of Indian migration is based on 'skill migration'. Most of them are young IT professionals. They push the rent up as they can effort to pay the rent. Wait till they have enough deposit to buy a house and start having kids!

It's from this RP Data update: http://somersoft.com/forums/showthread.php?t=101667

This was my thinking few years ago (about Sydney West)