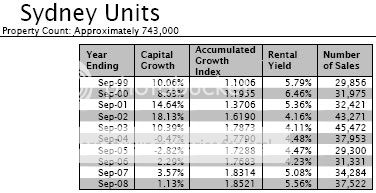

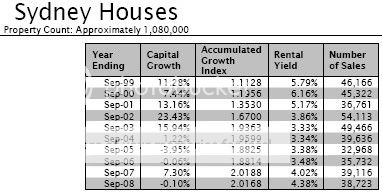

What about the 07 mini boom that coincided with the stock market peaking.

Not much of a boom. About 3% in real terms.

Foreign investment is negligible in the scheme of overall demand, or lack of. (no more graphs please)

Not negligible when we have such high overseas immigration levels, especially to Sydney.

Price gap not important when prices are historically very high by nay measure everywhere.

Price gap is very important, and the previous large price gap between Sydney and the other cities is one of the main reasons for such high interstate migration away from NSW recently. This is starting to reverse with the price gap narrowing.

Net Interstate Migration

FHOG minimal impact due to only affecting very bottom of the market. At best will create a short price spike at the bottom of the market for a short time.

When the bears thought FHBs were being priced out of the market, they used this argument to show prices would crash because FHBs are required to drive the whole market because an FHB sale leads to a sale higher up which leads to another sale etc. New money in is always required. You can't have it both ways! FHBs bring the new money into the market, which works its way up to the top.

The fall in interest rates wont be for long and then they will increase rapidly.

That is pure speculation. If I had a dollar for every time this year the bears said that rates definitely wouldn't fall, the banks definitely wouldn't pass on any cuts, the banks would raise rates even if the RBA cut them etc!

If rates look like rising again then I will fix.

Evidenced by myself rents flat and/or falling in Sydney of late.

I just put the rent up on one of my properties last week (Northern Beaches).

I have seen no cashflow properties for a long time. If there were nay, they probably wouldnt be worth buying.

Not looking hard enough. There are plenty out there, and there will be even more next year.

Increased population means squat when they cant afford the property.

But they can afford it. Especially when prices are 15% lower in real terms and interest rates are halved!

Banks keen to lend, but less keen then they have been for ages. Its all relative.

Still pretty keen though...

Sales volumes are low and have been for ages.

Wrong, see below.

Shadow.