Why it really is different here - Part 1: Australia vs USA, has already been discussed in the thread below.

http://www.somersoft.com/forums/showthread.php?t=46427

The gloomers frequently state that we are 'just like the USA' or 'just like Japan'. I think those claims have been largely discredited in various threads here, including the one linked above.

What has not been covered to such a degree is Australia vs UK. Are we 'just like the UK?' Let's discuss.

First of all, consider population growth. While the Australian population is growing at 1.7% per annum, the UK growth is only 0.4% per annum, less than a quarter of our growth rate! And even though the Rudd government has indicated that overseas immigration may be cut, it is very unlikely that Australia's population growth will fall anywhere close to UK levels.

Another important factor is the quality of overseas immigrants. While Australia has quite a restrictive policy of encouraging 'skilled' migrants, the UK has been taking in a very large share of poor and uneducated migrants from Eastern European countries, who tend to send most of their money back home to family instead of spending it in the UK economy, unlike our own skilled overseas immigrants who contribute towards the Australian economy to a much greater extent (and can better afford to buy/rent houses). Many of those UK migrants just packed their bags and went home when the UK economy started to stutter.

Another critical factor is interest rates. The UK banks have generally kept a larger slice of the official rate cuts for themselves, rather than passing it on to the consumer as has happened in Australia. Furthermore, the UK only started slashing official rates AFTER their house prices were falling sharply and the UK economy was in serious trouble. The RBA on the other hand has been much more proactive, cutting rates well in advance, ensuring that the rate cuts are passed on, and since they were starting from a higher official rate position to begin with, they have plenty more ammo left in the rate cut gun as well.

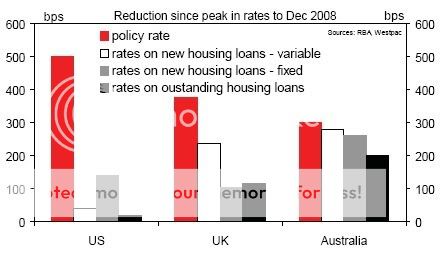

The chart below compares the reduction in official rates and mortgage rates across the UK, USA and Australia. It is clear that despite our official rate having fallen by the least amount (meaning we have much more scope for further official cuts), our fixed and variable mortgage rates have fallen by the greatest amount. The key difference here is that a much greater share of the cuts get passed on to the consumer in Australia.

Source: 25/02/2009 Housing Australia & UK comparison (PDF 117kb)

http://www.westpac.com.au/internet/publish.nsf/Content/WIMCER+Australian+Economic+Reports

The UK's economic problems began well in advance of their housing market downturn, and the UK banks had much more significant exposures to the sub-prime assets that triggered the current crisis. Many large UK lenders are heavily reliant on securitisation markets for funding (much more so than Australian banks). When those markets closed, these lenders no longer had access to funds. The Northern Rock collapse removed a very significant UK housing finance provider (estimate 10% mortgage market share, 110-120% LVRs common). After the NR collapse, credit was severly tightened by all UK lenders, max LVRs were slashed, and finance was no longer made available to 'higher-risk' borrowers.

Then we have the government debt position to consider. Australia entered this global downturn from a much stronger position since we had a strong budget surplus, no public debt, and we also have the Future Fund and the Infrastructure Fund, which together contain around $80 billion that can be made available for further stimulus.

Additionally, the UK (and especially London) economy is very much based around the financial services sector. And we know how that sector is going. Badly. The UK economy is in a much worse position than the Australian economy.

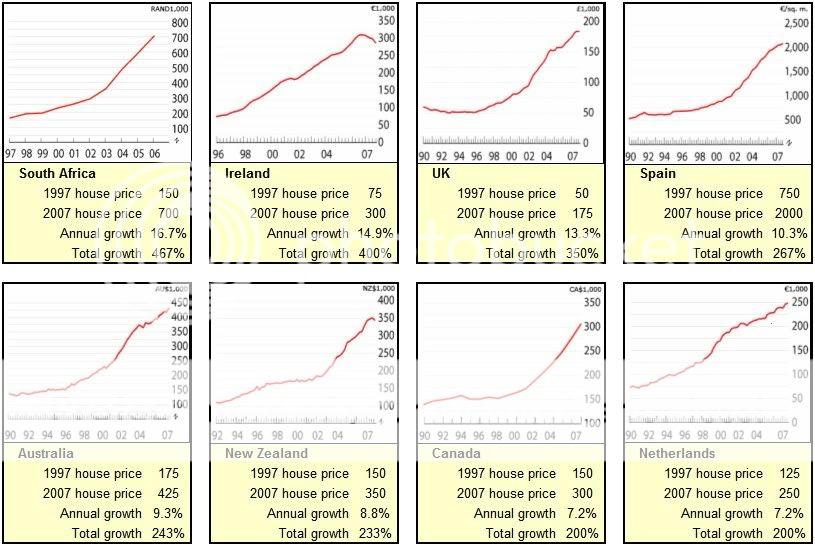

Finally, the UK property boom was considerably larger than ours to begin with.

Source: http://www.globalpropertyguide.com/real-estate-house-prices/A

Cheers,

Shadow

Last edited: